Child Benefit has been a cornerstone of the UK welfare system since its inception, providing financial support to families raising children.

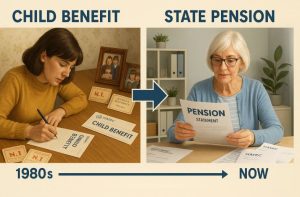

However, recent developments have uncovered significant errors dating back to the 1980s and 1990s, primarily affecting thousands of women who gave birth during that period.

HMRC, the government’s tax arm, has recently announced compensation packages for women impacted by these historical mistakes.

This error primarily affected National Insurance credits, which in turn impacted eligibility for the full State Pension.

This blog delves into the history of Child Benefit in the 1980s, the errors that have now come to light, and the compensation efforts underway. Whether you or someone you know might be eligible, understanding this development could be crucial.

What was Child Benefit in the 1980s?

Child Benefit in the 1980s was a government welfare scheme aimed at supporting families with the cost of raising children.

It replaced the Family Allowance system in 1977 and was designed to offer financial aid to parents or guardians, regardless of income, for each child under the age of 16, or 19 if they remained in education.

The idea was to ensure that parents had some financial relief to manage the expenses of childcare, education, and general upkeep.

Eligibility and Application Process

During the 1980s, the eligibility criteria for Child Benefit were relatively straightforward. Any parent or guardian residing in the UK with a child under the specified age was entitled to receive it.

Unlike today, the benefit was not means-tested, meaning that income levels did not affect eligibility. Parents simply needed to register their child’s birth and apply through local government offices to start receiving payments.

Payment Structure in the 1980s

The payment rates during the 1980s were modest but provided essential support. Payments were usually sent monthly and were designed to cover basic needs. The structure evolved over the decade, adjusting slightly for inflation but remaining a critical part of the welfare system.

How Was Child Benefit Managed in the 1980s?

The management of Child Benefit during the 1980s was primarily handled by HMRC, which was responsible for processing applications, distributing payments, and maintaining records.

Unlike today’s digital systems, record-keeping was largely paper-based, making errors more common and harder to trace.

Administrative Challenges

The 1980s saw limited technological support, which meant that any errors in record-keeping could go unnoticed for long periods. National Insurance contributions were sometimes miscalculated, affecting State Pension entitlements.

Women who took time off work to raise children were supposed to receive Home Responsibilities Protection (HRP) credits to safeguard their pensions, but many did not, leading to significant financial shortfalls.

Home Responsibilities Protection (HRP)

HRP was introduced to help parents, mostly mothers, who were out of the workforce while raising children. These credits were supposed to fill gaps in National Insurance contributions, ensuring that they still qualified for the State Pension.

However, errors in recording these credits have led to thousands of women missing out on pension entitlements, sparking the current compensation efforts.

HMRC Child Benefit 1980s – Latest News

Recent news has brought to light that HMRC has identified thousands of women who missed out on pension credits due to errors in the 1980s and 1990s. These women, who took time off work to care for their children, were supposed to receive HRP credits but did not. As a result, many are now owed an average of £7,859, with some payouts nearing £8,000.

HMRC’s Response

HMRC is actively reaching out to affected women, sending letters that detail their entitlements and the process for claiming compensation. This correction follows a government investigation that uncovered systemic errors in how HRP was recorded.

Ongoing Efforts

The government has pledged to identify all affected individuals and ensure they receive what they are owed. This initiative marks one of the largest corrective measures in recent welfare history.

Why Are Thousands of Women Affected by HMRC Errors?

The primary reason thousands of women are affected dates back to the way Home Responsibilities Protection (HRP) was recorded in the 1980s.

HRP was introduced to protect parents who took time off work to raise children, particularly women, by crediting them towards their National Insurance records. These credits were crucial for calculating State Pension eligibility.

Missing Records and Administrative Errors

During the 1980s, HRP credits were not always accurately recorded. Women who claimed Child Benefit automatically qualified for HRP, but due to record-keeping mistakes, many did not receive the credits they were entitled to. This oversight was largely due to paper-based administration and lack of digital verification.

Impact on Pensions

Because of these errors, thousands of women entered retirement without the full State Pension they were eligible for. Many were unaware of the shortfall until HMRC’s recent investigation brought the matter to light.

What Is the Connection Between Child Benefit and State Pension?

Child Benefit played a significant role in determining eligibility for the State Pension. Women who received Child Benefit for children under 16 were entitled to HRP, which reduced the number of years of National Insurance contributions required to qualify for the full State Pension.

Home Responsibilities Protection (HRP) Explained

HRP was designed to ensure that time spent out of the workforce for childcare did not negatively impact pension entitlements. For every year a parent received Child Benefit, HRP credits were supposed to be applied to their National Insurance record.

Consequences of Errors

Due to the administrative mistakes of the 1980s, many women did not receive their HRP credits, resulting in reduced State Pension payments. This gap in contributions left many women unknowingly underfunded in their retirement years.

How Are HMRC Addressing Historical Child Benefit Mistakes?

HMRC has acknowledged the errors and is actively working to correct them. Thousands of women who raised children in the 1980s and 1990s are now being contacted with letters explaining their right to compensation.

Compensation Process

The average payout is estimated at £7,859, with some reaching nearly £8,000. HMRC is sending letters to all known affected individuals, outlining the process for claiming the funds. The compensation is intended to address the gap in National Insurance contributions that affected pension payments.

Future Prevention Measures

To prevent similar errors, HMRC has modernized its record-keeping, moving to digital platforms that better track National Insurance credits and Child Benefit entitlements.

What Should You Do If You Think You Are Owed Money?

If you believe you may be entitled to compensation, you should look out for a letter from HMRC. Women who raised children between 1978 and 2000 are the primary recipients of this outreach.

Steps to Take

- Check your National Insurance record to identify any gaps.

- Contact HMRC for clarification if you notice missing HRP credits.

- Follow the instructions in the letter from HMRC to claim your compensation.

Are There More Errors Expected to Surface?

The discovery of these historical errors has prompted questions about whether other mistakes may exist. HMRC is currently auditing its records to identify any further discrepancies, particularly those affecting women who received Child Benefit in the past.

Future Implications

The ongoing review could lead to more letters being sent out and additional compensation claims being processed. HMRC’s commitment to resolving this issue is likely to set a precedent for greater accountability in welfare benefits.

Conclusion

The revelation of errors in HMRC Child Benefit records from the 1980s highlights a critical oversight that affected thousands of women. With compensation now being issued, it serves as both a resolution and a warning for better record-keeping in the future.

If you or someone you know might be impacted, taking action now can help recover what is rightfully owed.

FAQs

What is the average payout for affected women?

The average payout is approximately £7,859, with some reaching up to £8,000.

Who is eligible for this compensation?

Women who raised children between 1978 and 2000 and missed out on HRP credits are eligible.

How do HRP credits affect State Pension?

HRP credits reduce the number of National Insurance years required for a full State Pension.

What steps should I take if I haven’t received a letter?

If you believe you qualify but haven’t received a letter, you should contact HMRC’s National Insurance helpline. They can help you review your records and guide you on the claims process.

Will the compensation affect my current benefits?

No, the compensation you receive from HMRC for missed HRP credits does not affect your current Child Benefit or other welfare entitlements. It is a one-time corrective measure to address past errors.

How long will it take to receive the compensation?

Once you have confirmed your eligibility and submitted the necessary documents, HMRC expects to process the compensation within a few months. However, this may vary depending on individual circumstances and verification requirements.