Many UK households continue to face intense financial pressure due to rising costs. From rent and groceries to energy bills and transport, everyday expenses have become a challenge, especially for pensioners, single parents, disabled individuals, and part-time workers.

To address this hardship, the UK government has, in recent years, stepped in with targeted support. One of the most talked-about measures currently circulating in the news is the rumoured £650 one-off cost of living payment for 2025.

However, it’s essential to understand that as of now, no official government announcement has confirmed a £650 payment for 2025. This guide clarifies what is known, how past cost of living payments worked, and what households should do to stay informed and avoid scams.

What Is the £650 One-Off Cost of Living Payment?

The reported £650 one-off cost of living payment is expected (if confirmed) to provide direct financial aid to low-income households. It would follow the model of earlier cost of living schemes introduced between 2022 and 2024, which aimed to help cover essentials like food, energy, and fuel costs.

This payment is designed to be:

- Non-taxable

- Separate from regular benefit payments

- Exempt from the benefit cap

If introduced, the Department for Work and Pensions (DWP) would likely oversee payments, alongside HM Revenue & Customs (HMRC) for tax credit claimants, ensuring eligible households receive funds directly to their usual benefit accounts.

Why Is This Payment Important?

Cost of living payments are a critical lifeline for millions facing soaring household bills. Inflation, energy market fluctuations, and stagnant wages have deepened financial challenges.

Key reasons why this payment matters include:

- Offsetting extra costs for vulnerable groups

- Supporting those on means-tested benefits

- Providing immediate relief without affecting benefit entitlements

Who Might Be Eligible for a £650 One-Off Payment in 2025?

Based on previous schemes, eligibility would likely depend on receiving one or more means-tested benefits during a government-specified assessment window.

Likely eligible benefits (if similar to past schemes):

- Universal Credit

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Income Support

- Pension Credit

Important notes:

- Contributory or new-style ESA/JSA alone would not qualify

- Tax credits (Child Tax Credit, Working Tax Credit) would qualify only if managed by HMRC

- Those with joint claims would receive one payment per household, not per individual

How Did Past Cost of Living Payments Work?

From 2022 to 2024, the government paid several rounds of cost of living support:

| Payment Amount | Benefit Type | Payment Period |

|---|---|---|

| £326 | Means-tested benefits | Summer 2022 |

| £324 | Means-tested benefits | Autumn 2022 |

| £301 | Means-tested benefits | Spring 2023 |

| £300 | Means-tested benefits | Autumn 2023 |

| £299 | Means-tested benefits | Early 2024 |

| £150 | Disability Cost of Living Payment | 2022, 2023 |

| £150–£300 | Pensioner Cost of Living Payment | Paid with Winter Fuel Payment |

These payments were automatic, no application was needed. Eligibility was assessed using benefit data from specific qualifying periods.

Do You Need to Apply for the £650 Payment?

If the £650 payment is confirmed, it will not require an application. Based on past schemes:

- Eligible claimants are identified automatically through DWP and HMRC systems

- Payments are made directly to the account linked to existing benefit payments

- Scam messages asking people to apply or provide personal details are fraudulent and should be ignored

To prepare:

- Ensure benefit details and bank information are up to date

- Monitor official government channels for announcements

- Be cautious of unsolicited emails, texts, or phone calls

When Would the £650 Cost of Living Payment Be Paid?

If introduced, payment dates would likely follow a phased schedule based on benefit type. Looking at past rollouts:

- DWP-handled benefits (like Universal Credit, Pension Credit) were paid first

- HMRC-handled benefits (like Tax Credits) followed slightly later

For example, in 2022–2024, payments typically arrived in summer or autumn, with millions of payments processed over several weeks.

How Will You Receive the Payment?

Payments would be delivered as:

- A direct deposit to the bank account used for your regular benefits

- Clearly labelled, often with a reference like “DWP COLP” or “HMRC COLP”

- Separate from regular benefit or pension payments

If you change bank accounts or have benefit entitlement backdated, the system is designed to issue the payment automatically once updated.

What to Do If You Don’t Receive the Payment

For past payments, some people experienced delays due to account changes, benefit reviews, or system errors. If you believe you were eligible and did not receive a payment:

- Wait until the end of the payment window

- Check your benefit account or bank statement

- Contact the DWP or HMRC using official contact channels

Be aware that if it’s later determined you were not eligible, the government may request repayment.

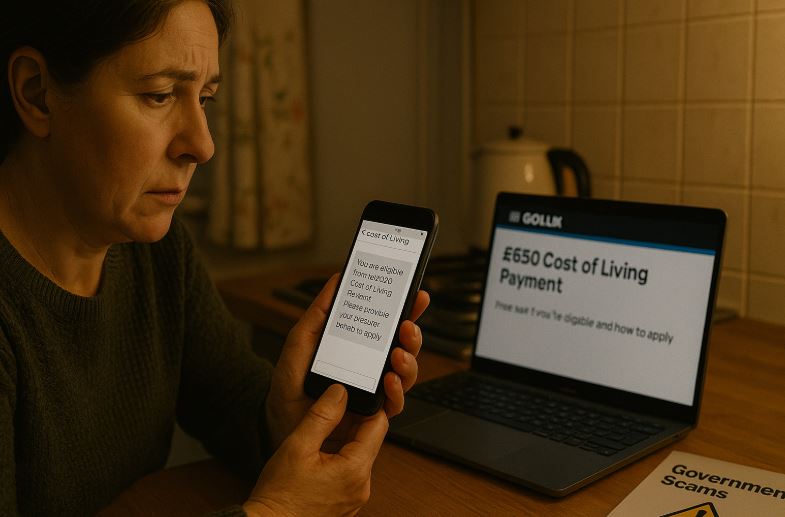

How to Stay Safe from Cost of Living Payment Scams?

Scammers often exploit confusion around government payments. Warning signs include:

- Requests for bank details via text, email, or phone

- Claims you need to apply or “confirm eligibility” through unofficial websites

- Offers of “help” in exchange for a fee

To stay safe:

- Only trust updates from official sites like gov.uk

- Contact DWP or HMRC directly if unsure

- Report suspicious messages to relevant authorities

Additional Government Support

Even without an officially confirmed £650 payment, households can explore other support measures, including:

- Household Support Fund (via local councils in England)

- Discretionary Assistance Fund (Wales)

- Crisis Grant or Community Care Grant (Scotland)

- Discretionary Support or Short-Term Benefit Advance (Northern Ireland)

- Warm Home Discount, Winter Fuel Payments, Energy Bills Support Scheme

Additionally, using an independent benefits calculator can help identify extra help you may qualify for.

Conclusion

The £650 one-off cost of living payment (2025) remains unconfirmed as of now. While speculation continues, it’s critical to rely only on official announcements and understand how similar past payments worked.

If the government moves forward with a new payment, eligible households can expect:

- Automatic delivery without application

- Payments handled via DWP or HMRC depending on benefit type

- No impact on tax or existing benefit entitlements

Until then, stay informed, keep your benefit details updated, and use official resources to explore additional help during this period of rising living costs.

FAQs

Is the £650 payment confirmed for 2025?

No, as of now, the payment is unconfirmed.

Do I need to apply if it’s announced?

No, it would be paid automatically based on benefit records.

Will the payment affect my other benefits?

No, past payments were non-taxable and didn’t count as income.

What benefits qualified for past cost of living payments?

Universal Credit, Pension Credit, Income-based JSA/ESA, Income Support, Child and Working Tax Credits.

How can I check if I’m eligible?

Check your benefit award letters or online portal, and monitor announcements from gov.uk.

What should I do if I receive a suspicious message?

Do not respond. Report it to DWP, HMRC, or Action Fraud, and only trust official sources.